"Cryptocurrency is like the Wild West. It's full of opportunity, but it's also full of danger. Be prepared to take risks, but don't be afraid to explore."

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. (Source: Wikipedia) In recent years, digital currencies certainly stand out enough to be noticed and prevalence. From headlines to casual conversations, these digital assets have become an integral part of our financial landscape. Cryptocurrencies such as Bitcoin, Ethereum, and Ripple, have upset customary monetary frameworks and started the creative mind of people and institutions alike. Yet, what precisely is digital currency, and how can it work? In this blog entry, we will investigate the major ideas driving cryptocurrencies, their basic technology, and the mechanics that make them function. Unlock the secrets of cryptocurrency and understand how it works. Explore blockchain, wallets, mining, and more. Join the conversation now!

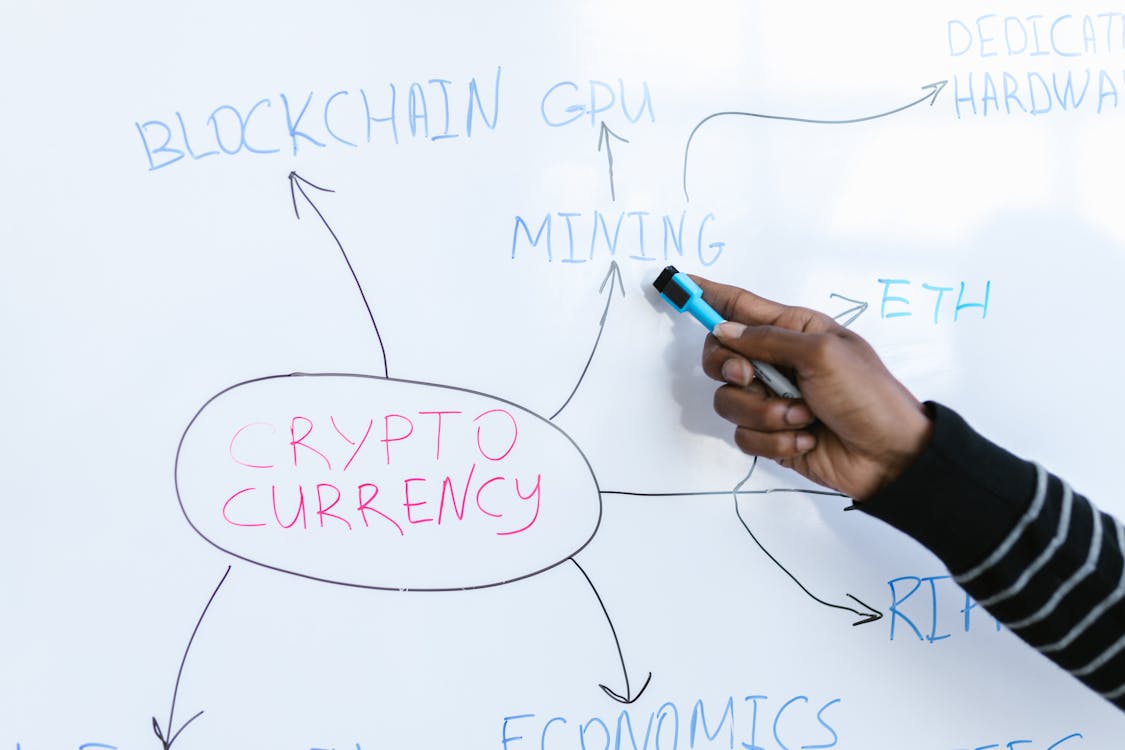

Understanding Cryptocurrency

At its center, digital money is a computerized or virtual type of cash that uses cryptography for secure transactions and to control the creation of new units. Unlike traditional currencies issued and regulated by central banks, cryptocurrencies are decentralized and operate on a technology called BLOCKCHAIN.

Blockchain Technology

The blockchain serves as the underlying infrastructure for most cryptocurrencies. A dispersed record keeps the records of all exchanges across an organization of PCs, called nodes. This decentralized nature disposes the requirement for a central authority, like a bank, to confirm and approve transactions. Instead, consensus algorithms are used to ensure the accuracy and security of the network.

Every exchange in a cryptographic money is gathered into a block, which is then added to the chain of previous blocks, shaping a sequential grouping of transactions. This chain is publicly accessible and transparent, allowing anyone to verify the validity of transactions. The decentralized idea of the blockchain makes it impervious to fraud, censorship and tampering.

Cryptographic Security

Cryptography plays a crucial role in securing transactions and maintaining the integrity of cryptocurrencies. It includes the utilization of complex mathematical algorithms to encode data, guaranteeing that it stays private and tamper-proof. With regards to digital currencies, cryptography is utilized to get wallets, verify transactions, and control the creation of new units.

Wallets and Addresses

To participate in the cryptocurrency ecosystem, users need a digital wallet. A wallet is a software application that enables users to safely store, send, and accept their digital currencies. Every wallet has a unique address, which fills in as a public identifier for exchanges. This address comprises of a progression of alphanumeric characters and is like a bank account number.

At the point when a client needs to get funds, they share their wallet address with the sender. The sender then utilizes that address to start an exchange, moving the specified amount of digital money to the receiver's wallet. The transaction is digitally signed utilizing the sender's confidential key, which guarantees the credibility and authenticity of the exchange.

Transaction Verification

When an exchange is started, it should be confirmed by the organization of nodes in the blockchain. This verification process prevents fraudulent transactions and double-spending, where a same amount of digital currency is spent at least a time or two.

In many digital forms of money, including Bitcoin, the verification cycle is finished through a consensus algorithm called Proof of-Work (PoW). Miners, who are nodes on the network, compete to solve complex mathematical problems. The first miner to solve the problem receives a reward in the form of newly created cryptocurrency and fees associated with the transaction.

Miners employ significant computational power to solve these puzzles, which ensures the security and integrity of the network. When a block is effectively mined, it is added to the blockchain, and the transaction is thought of as confirmed. Confirmations provide increasing levels of confidence that a transaction is valid and irreversible.

Supply and Mining

One defining feature of many cryptocurrencies is their limited supply. Unlike traditional currencies that can be printed or minted at will, cryptocurrencies often have a maximum supply cap. For example, Bitcoin has a maximum supply of 21 million coins. This scarcity adds to their value proposition.

New units of cryptocurrencies are created through the mining process. Mining involves solving complex mathematical problems, as mentioned earlier. As a reward for their computational effort, miners are granted a certain amount of newly created cryptocurrency. However, as the supply of cryptocurrencies approaches its maximum limit, the rewards for mining decrease, which helps maintain the scarcity and value of the digital asset.

Use Cases and Applications

Cryptocurrencies offer various use cases and applications beyond being a digital form of money. They can be utilized for peer-to-peer transactions, settlements, micropayments, Decentralized Finance (DeFi), and, surprisingly, as a store of significant value. Furthermore, blockchain technology can possibly reform industries, for example, supply chain management, medical care, voting systems, and that's only the tip of the iceberg, by providing transparency, immutability, and security.

Challenges and Future Perspectives

While cryptocurrencies and blockchain technology have shown immense potential, they also face challenges. Regulatory concerns, scalability issues, energy consumption, and the risk of cyber attacks are among the prominent challenges that need to be addressed for widespread adoption.

Nevertheless, the future of cryptocurrencies looks promising. They have already disrupted traditional financial systems and opened up new possibilities for economic inclusion and innovation. As the innovation advances and develops, digital forms of money can possibly reshape our financial landscape and revolutionize various industries.

Conclusion

Cryptocurrencies, fueled by blockchain technology and cryptographic security, have arisen as another type of digital money. Their decentralized nature, transparency, and potential for development certainly stand out of people, businesses, and governments around the world. Grasping the rudiments of digital money, for example, the blockchain, wallets, transaction verification, and mining, is fundamental for anyone with any interest at all in investigating this astonishing and quickly advancing field. While challenges stay, the eventual fate of cryptographic forms of money looks brilliant, and their effect on our general public and economy is simply starting to unfold.

Interesting Facts About Cryptocurrencies

- The price of Bitcoin has increased by over 500,000% since its inception in 2009.

- Over 15,000 companies worldwide accept Bitcoin as a payment method.

- El Salvador is the only country that has fully adopted Bitcoin as a legal tender.

- The U.S. is the biggest crypto mining country in the world.

- There are over 80 million Blockchain cryptocurrency wallet users.